JIP-33: A Jito X Coinbase Collaboration

Category: Protocol

Abstract

This proposal seeks DAO approval to prepare a strategic collaboration between the Jito Network and Coinbase to integrate JitoSOL into Coinbase’s product suite and delegate attributable JitoSOL stake to a Coinbase-operated Solana validator under the JIP-27 framework for Directed Stake.

This arrangement will deepen JitoSOL’s liquidity and adoption through Coinbase’s vast global distribution, with the potential to radically expand JitoSOL TVL.

Motivation

The Jito Network’s mission is to advance the performance and accessibility of Solana staking through the Jito ecosystem. Forging a collaboration with Coinbase, which is one of the most trusted and widely used exchanges, will facilitate the accessibility of JitoSOL to a global user base and vastly expand its reach beyond its existing DeFi-native user base.

The collaboration ensures that new inflows of stake attributable to Coinbase users are directed toward Coinbase-operated validators. These validators will catalyze new, incremental stake growth that would not otherwise exist.

Crucially, this will not impinge upon existing delegation, since the TVL is directly attributable to the collaboration and would not exist otherwise.

JIP-33 creates an extraordinary arrangement, for an extraordinary collaborator. This deep alignment with Coinbase both via its CEX venue and Base, will expose the Jito Network to Coinbase’s users and millions of funded addresses on Base, opening up not only substantial new stake, but new holders and new liquidity.

This strategic alignment could bring substantial benefit to both the Jito Network and Coinbase, with Jito being positioned to leverage Coinbase’s industry-wide and market leading network effects, and Coinbase being able to offer enterprise-grade, maximally decentralised LSTs to its users.

This is a huge opportunity for JitoSOL, which as an asset could now take on a distribution profile similar to USDC, which reached its market leading network effects through strategic partnership with Coinbase. Additionally, Coinbase has a broad set of products and services that could open up as potential integrations in the future for JitoSOL and other Jito products.

Collectively, Coinbase users are one of the largest pools of SOL in the industry. Providing those users with easy access to mint JitoSOL could generate a huge TVL boost, which in combination with JIP-28 and JIP-31 will continue the Jito’s aggressive drive towards BAM stake adoption and growth of the network.

In summary, JIP-33 proposes a collaboration with Coinbase, which could significantly increase the TAM of JitoSOL and the wider Jito Network product suite and deepens Coinbase’s connection to the Solana network as a whole.

Key Terms

-

Attributable JitoSOL: The portion of JitoSOL supply minted or held by Coinbase retail users or on the Base network that is delegated to Coinbase validators.

-

Validator Commission: The share of staking rewards retained by a validator; in this proposal, Coinbase validators will retain 5% of staking rewards and 10% of Jito tip revenue.

-

JIP-27: The recent protocol improvement that enables permissioned validator inclusion and directed staking within the JitoSOL delegation set.

-

JIP-28: The recent protocol improvement that ensures that all delegated stake in the Jito Stake Pool trends towards validators that run BAM.

-

JIP-31: The recent Jito protocol improvement that directs 100% of protocol revenue to validators that run BAM.

-

Directed Staking: The framework that allows JitoSOL stake to be delegated to specific validators based on DAO-approved parameters (see JIP-27).”

Specification

Upon passage and Coinbase product launch, the Jito engineering team will manage delegation of Attributable JitoSOL stake to Coinbase-operated validators using the Directed Staking framework outlined in JIP-27. This delegation does not modify existing validator weighting policies or affect allocations to validators outside of the scope of this collaboration.

JIP-33 is specified as followed:

-

Coinbase will begin integration of JitoSOL into their product suite, including:

-

A mint/burn product from SOL to JitoSOL in the Coinbase app

-

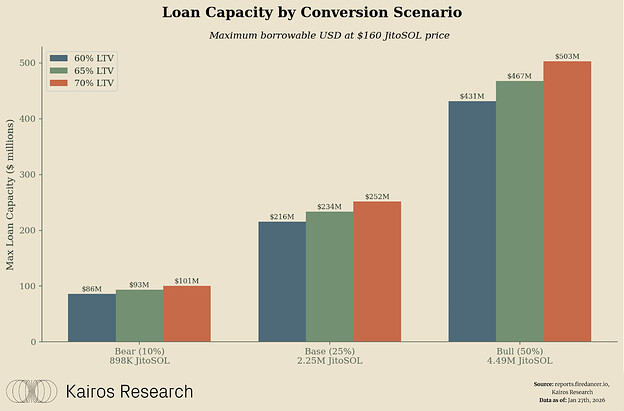

USD loans against JitoSOL from the Coinbase app

-

JitoSOL to be featured on the Base network.

-

A broad educational and marketing campaign to their users, as designed by Coinbase.

-

-

Relax the 0% commission directed staking restriction for Coinbase aligned validators.

-

The applicable Coinbase validators will run the BAM client

-

The Attributable JitoSOL to Coinbase will be clearly tracked and reported to the DAO via a suitable venue on the jito.network website.

-

Potential modifications to the interceptor mechanism*.

-

All “management fees” currently attributed towards the DAO on staking rewards from Coinbase stake will be directed in totality to an address that Coinbase owns.

-

Access to a proportion of the JTO incentive budget outlined in JIP-34

Benefits / Risks

Benefits:

-

Expanded Distribution: Coinbase integration provides JitoSOL exposure to Coinbase’s global retail userbase.

-

Substantial Growth: All attributable JitoSOL stake is net-new; no existing validator loses delegation.

-

Potential flywheel: Strengthens Jito’s position as the leading Solana liquid staking protocol and enhances its institutional credibility.

Risks:

- Yield Dilution: The Coinbase validator intends to operate at the higher end of the Stake Pool commission range, as detailed above, resulting in slightly lower effective yield relative to the broader JitoSOL validator set. If attributable Coinbase stake grows to a large portion of total JitoSOL TVL, aggregate yields for all JitoSOL holders could modestly decline due to weighted-average dilution.

Figure 1: Projected JitoSOL APY Impact based on Coinbase share of the Jito Stake Pool

-

Concentration Risk: Temporary increase in stake concentration toward Coinbase-operated validators, mitigated by overall network growth.

-

Precedent Risk: Setting a higher-than-standard commission rate could create future expectations for other partners; however, this case is unique given Coinbase’s scale and distribution value.

Outcomes

-

Coinbase becomes a validator within the JitoSOL validator set

-

JitoSOL becomes broadly available to Coinbase users, with staking yield and Jito tips transparently distributed per protocol norms.

-

New delegation inflows attributable to Coinbase expand JitoSOL’s market share and protocol fees.

Cost Summary

No direct on-chain treasury allocation is required.

-

All validator economics (commissions, tips) are automatically managed through the delegation contract.

-

Access to the JTO incentive budget articulated in JIP-34 will be allocated towards liquidity incentives on Base and user onboarding incentives to accelerate growth under this collaboration.

Further technical details on modifications, or integrations will be provided before JIP-33 proceeds to vote

Technical Details: a temporary transition of interceptor upgrade authority will be transferred to the dev council to facilitate technical integration. Authority transferred by DAO instruction will be returned to the DAO, as soon as the integration is completed. No further action is required from the DAO.

The Vote is Live: Go to Realms to Vote JIP-33: A Jito X Coinbase Collaboration | Jito